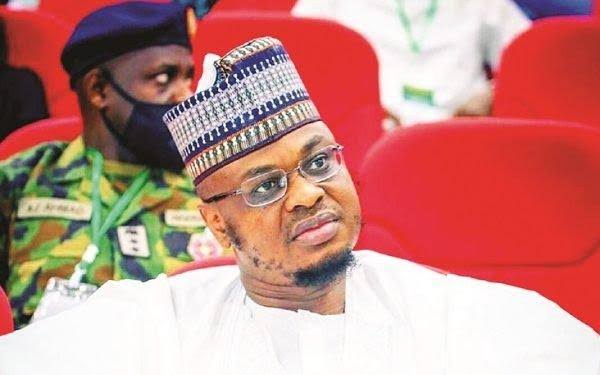

Contrary to the pronouncement by the minister of communications and digital economy, Isa Ali Pantami, that the five percent telecom levy had been suspended, the director-general of the Budget Office, Ben Akabueze, has maintained that the tax remains in effect as the Budget Office of the Federation and the Federal Ministry of Finance, Budget and National Planning had not been advised about the suspension.

Speaking on Arise News channel, Akabueze stressed that the five per cent tax on telecom services is part of the federal government’s expected revenue to fund the medium-term expenditure framework and that the bill had been passed into law.

He argued that a suspension would mean further fiscal deficit for Nigeria, just as he said telecom operators in Nigeria are not overtaxed but rather undertaxed.

“This is a matter that would be resolved in due course. I’m a member of the fiscal policy and tax policy review committee which includes members of the private sector; in fact, the majority of its members are from the private sector and we deliberated extensively on this matter before we arrived at including this in the finance bill.

“And one of the things that we looked at that time – so you know – four years ago, at least 21 countries in Africa had excise taxes on telecom services; in fact, in all of these countries also, they had VAT rates that were, on the average, double the VAT rate for Nigeria.

“There are extensive studies on this subject about the taxation of telecommunication companies in Africa and other developing countries, and I assure you that the average effective tax rate, which is called the AETR on telecommunications, in Nigeria is below the African average. There are several countries in Africa where the AETR on telecommunications is over 90 per cent which is giving rise to the concerns that in some places they may currently be overtaxed, but certainly not in Nigeria.

“Again, on this continent, as of today, we have the lowest tax to GDP ratio. And so, at a time when we face existential revenue challenges, I think that we all need to be really circumspect about what views we take on this matter.”

Akabueze further noted that there were several consultations with operators before the bill was passed and pronouncement was made, and that a reversal would further dampen Nigeria’s fiscal problems.

“This wasn’t something that the Ministry of Finance woke up and introduced. The finance bill went through the Federal Executive Council; it went to the National Assembly as, an executive bill from Mr. President, there were public hearings, and at the end of the day they passed it into law.”

According to him, his office engaged with different stakeholders including Customs, the Nigerian Communications Commission (NCC) and other industry practitioners to discuss the modalities for the implementation before

“Let me say, I don’t know about the suspension, I mean, this is the law now. So, I haven’t heard beyond what I’ve read in the media. We haven’t been advised about the suspension. So, for instance, recently, the Federal Executive Council passed the medium-term expenditure framework for 2023 and 2025. That includes projections for this tax; that framework is currently before the National Assembly in the last two weeks, and the Finance Committee of the National Assembly has been holding engagements with agencies of government on this.

“So, when we are formally advised that this is no longer applicable, then we will have to rework the medium-term expenditure framework. What that means is, of course, that the projected revenues will diminish, and the deficits would increase, which means that we either have to cut back on expenditure or increase debt,” he added.