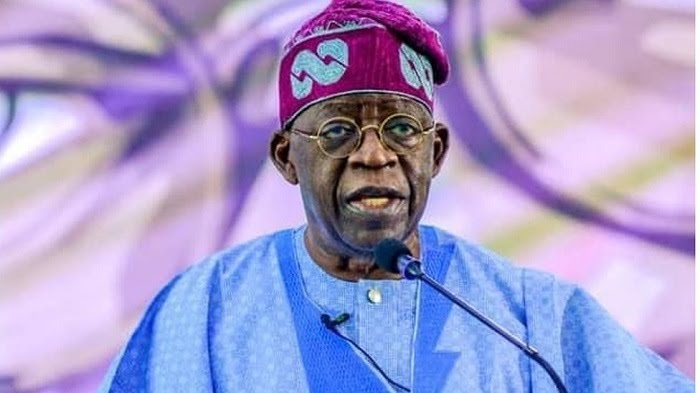

President Bola Tinubu to intervene, urging the Central Bank of Nigeria (CBN) to provide immediate bailout funds to the Nigeria Deposit Insurance Corporation (NDIC) for full reimbursement.

Speaking on behalf of the affected depositors, Ibrahim Elisha said the NDIC has struggled to execute full payments, with recent statements confirming financial constraints. Ten months after liquidation, many depositors remain unpaid despite repeated assurances.

The depositors criticized the NDIC’s plan to pay depositors pro-rata, arguing that this approach is unacceptable given past financial interventions by the CBN, including:

N460 billion bailout to First Bank on behalf of Heritage Bank

Facilitating the Providus Bank and Unity Bank merger

N700 billion support to Unity Bank with favorable repayment terms

CBN’s acquisition of Keystone Bank to prevent collapse

They warned that failure to act swiftly could erode public confidence in the Nigerian banking system, creating widespread distrust and hardship for individuals who relied on CBN’s prior assurances about Heritage Bank’s stability.

The depositors urged the Presidency and National Assembly to intervene, emphasizing that further delay could tarnish Nigeria’s financial reputation globally and undermine trust in government-backed financial institutions.